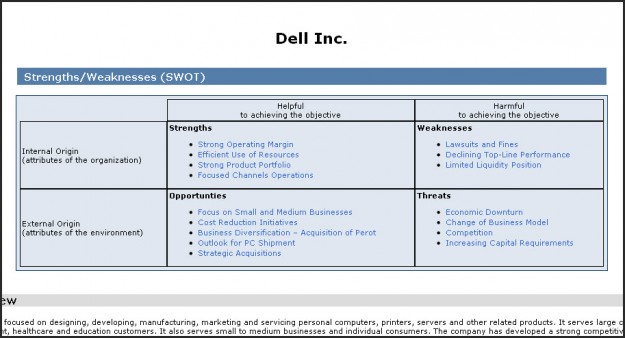

Business students often ask how to find SWOT (Strengths, Weaknesses, Opportunities, Threats) analyses of companies. Until now, our only source for ready-made SWOT analyses was Datamonitor company reports, available via Business Source Premier.

Now we have another source: OneSource Global Business Browser. And the SWOTs here are more detailed and analytical than those from Datamonitor.

To access the OneSource Int’l SWOTs, follow these steps.

- From the main UST Libraries page click on the Databases A – Z link.

- On the OneSource Global Business Browser landing page search for your company

under the “Companies” search box. - Search for your company within the “Companies” box. Remember, most companies in OneSource are large publicly traded corporations.

- Once you’ve identified your company among the search results (yours will usually be the one headquartered in the US, with a US stock listing), click on the Strengths/Weaknesses link among the list of links on the right hand side of the page.

Can’t find a SWOT? Don’t panic.

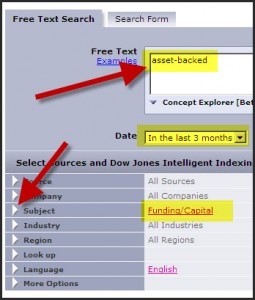

Remember that the SWOT analysis is not difficult to make. First grab a SWOT from Reference USA International, using the process outlined above, to use as a template. Use Proquest Newsstand Complete, Factiva, and Business Source Premier to retrieve press releases and media articles on company and its executives for the past twelve months. (Focus on CEO, Chairman, and CFO interviews, new product releases, earnings releases, and stock analyst opinions on the industry or company.) Within Business Source Premier, also look for a Datamonitor company profile. If the company is public, go to their website–usually the “investors” or “company information” sections–to find the company’s SEC 10-K, 10-Q, and 14-A filings.

Still unconvinced? (Still reading?) Here’s a brief explanation of how valuable a SWOT can be, from The Blackwell Encyclopedia of Management:

An acronym of strengths, weaknesses, opportunities, and threats, SWOT analysis provides a simple but powerful tool for evaluating the strategic position of the firm. It is especially useful for senior executives undertaking a fundamental reappraisal of a business, in that it permits a free thinking environment, unencumbered by the constraints often imposed by a finance driven budgetary planning system.